Hardcover |

Kindle Edition |

Thrilling Incidents In American History |

Perry's Saints |

Prev |

Next

Hardcover |

Kindle Edition |

Thrilling Incidents In American History |

Perry's Saints |

Prev |

Next

The Jet MakersThe Aerospace Industry from 1945 to 1972• Title • Introduction • Preface • Acknowledgements • I: World War II: Aviation Comes of Age • II: The Aerospace Industry since World War II: A Brief History • III: The National Military Strategy: Background for the Government Markets • IV: The Principal Government Market: The United States Air Force • V: The Other Government Markets: The Aerospace Navy, the Air Army, and NASA • VI: Fashions in Government Procurement • VII: The Heartbreak Market: Airliners • VIII: Design or Die: The Supreme Technological Industry • IX: Production: The Payoff • X: Diversification: The Hedge for Survival • XI: Costs: Into the Stratosphere • XII: Finance and Management • XIII: Entry into the Aerospace Industry • XIV: Exit from the Aerospace Industry • XV: The Influence of the Jet Engine on the Industry • Notes • Acronyms • Annotated Bibliography |

VIITHE HEARTBREAK MARKET: AIRLINERSSince World War II the airliner market has exerted a considerable influence on the aerospace firms. Its end product is one that the firms are interested in and qualified to build; and it offers the promise of shelter from the downs of the military aircraft market, although the commercial business has not in fact proved countercyclical.Its greatest appeal has been its potential for big sales and long, profitable production runs. Air transportation geography in the United States gives American manufacturers the advantage of a prosperous, large population with major urban centers scattered at great distances. This provides an economical basis for building many large airliners. The airline managers have usually been an optimistic group with regard to the growth of air transportation, and their attitude has been shared by the manufacturers. And results have often outrun optimistic forecasts: revenue passenger-miles, the best index of airline traffic in the period, have risen over 2400 percent since 1946 and virtually destroyed the once-dominant railroad and steamship passenger services. Yet the commercial market has been fraught with risk. Every single one of the successful types built has taken worrisome years to move into the black. The commercial airliner business has caused desperate crises twice for Douglas, General Dynamics, Lockheed, and Martin, and once for Fairchild and Northrop. Douglas’ second time finished the company, although Douglas once dominated the commercial business more thoroughly than did Ford the auto industry, and in the early seventies Lockheed’s fate was still unknown. Every single one of the companies studied has made at least one try for the commercial market. The aggregate failure costs would be large even without such enormous before-tax losses as General Dynamics’ loss of more than $400 million on the 880/990 and Lockheed’s $120 million loss on the Electra.1 Dozens of types have been essayed and have died in various stages from desk-top designs to prototypes. The reasons for difficulty have been manifold. Timing has been critical. The market has often been too small to support production of all the entries. There were twenty-seven designs offered in the immediate postwar years when the total number of airliners in American service was only about a thousand, and break-even levels called for production of 200 to 350 aircraft. The state of airline finances has occasionally held back purchases. The airlines’ management has sometimes misjudged the type of equipment needed even though the airlines have a basic advantage over the military in such decisions because commercial transportation is always “at war.” Airline managers have ordered more aircraft than they finally purchased, and the manufacturers have misjudged both their immediate customers and the ultimate customer, the public. Sometimes inept production management has made things worse. The difficulties listed above have both contributed to and have been aggravated by the cyclical purchase of airliners. The primary causes for the cycles have been technological advances, alternating exuberance and despair on the part of the airlines, and the economic basis of traffic. On the downside of the cycle, gluts on the used airliner market and financial problems have aggravated the gloom produced by operating results. Technological advances have produced aircraft with significantly lower operating costs and with markedly greater appeal to the passenger. Whenever this has happened, all airlines have been forced into large-scale reequipping; if one airline alone had superior equipment it could achieve deep inroads into its competitors’ business. One of Juan Trippe’s coups was being the first to order both 707’s and DC-8’s, thus assuring Pan American Airways of all initial jetliner production. Increased traffic has caused too much buying in the euphoria of sudden prosperity and available funds. Although it was doubted for years, it is now generally accepted that the airline traffic demand is price-elastic. Efforts to capitalize on this by extravagantly promoting special fares may have contributed to the overoptimism on the upside of the cycle. Demand is also cyclical according to general business conditions.— The result of all these forces has been crests in airliner buying and troughs of overcapacity which produced a great supply of seats in excess of the passenger demand. OVEREXPANSION I: 1945-1946When C. R. Smith, former major general and deputy commander of the 3,700-plane global Air Transport Command, returned to the presidency of American Airlines after the war, he voiced the exuberance of the times. In a speech to his executives he said: “Anybody who can’t see the day when we will fly a thousand planes, damn well better get out right now.”2 Discounting the thousand planes as a figure of speech and the pep-talk exaggeration natural for such a situation, Smith still was grossly overconfident about the immediate future. Ten years later American had a fleet of 188 liners whose capacity was roughly equivalent to 500 of 1945’s DC-3’s.Early traffic results in postwar 1945 and in 1946 seemed to confirm the rosy hopes, however, and there was an avalanche of orders for airliners. Revenue passenger miles doubled in one year, and transatlantic service began in earnest. In the summer of 1945 nineteen airlines ordered 409 transports of nine types and were talking about ordering another 566. Martin alone thought it would sell 700 of its 202 model twin-engine airliners. To supply this market the aircraft firms offered a wide variety of types with two, three, four, and six engines, from feeder airliners to land-based giants and flying boats. Everybody except Fairchild, Grumman, and North American was selling airliners. Overoptimism was not the only reason for the aerospace companies’ rush into airliners. With the progress in aeronautics it was expected that the old DC-3’s would soon be made obsolete, a belief that was partly correct. Republic offered its Rainbow, hoping to capitalize on a wartime design. Douglas had a unique idea, contrarotating propellers behind the tail, among a variety of designs. Doubtless other companies besides Boeing and Martin and Convair took up commercial work partly as a means of keeping design and technical teams busy. If profits were not high, the ventures could still contribute to overhead costs while bridging the gap before anticipated new military work. Other factors contributing to the increase in airliner production were the cushion of tax law carryback provisions, the gross miscalculation that development costs would run only about $3 to 5 million instead of the $40 million which was actually reached, and developmental momentum from the war. The companies were each aware of the proliferation of designs, and knew that few would succeed. Yet they pressed ahead. It seems evident that their situation fits the “prisoner’s dilemma” of game theory, with the forced outcome of the choice to seek a contribution to overhead.3 The bubble soon burst for the manufacturers when their big customer, the government, entered the used airplane market where bargain-basement asking prices were the rule. Four thousand C-47’s, the military version of the DC-3, were dumped onto the market at around $60,000, and conversion costs were only $40,000 to $90,000. The total cost was thus about half the cost of a new Martin 202 or Convair 240, even though the new planes were grossly underpriced immediately after the war through miscalculation of development and production costs. In the spring of 1946, of 256 aircraft received by airlines, 146 were converted C-54’s, the military version of the DC-4. OVERCAPACITY I: 1947-1948Directly behind the flood of used aircraft came airline problems. Revenue passenger-miles leveled off at around eight billion. Costs zoomed as the airlines had carelessly overextended themselves on equipment and personnel. The number of passenger seats doubled from 1945 to 1946, matching the increase in revenue passenger-miles. But in 1947, with the demand leveling off, the supply of passenger seats increased again about 50 percent. In 1948, with demand still stable, the seat capacity rose over 16 percent. The supply is understated because it rises faster than a physical count of the seats: the fact that the newer aircraft were faster gave their seats more “turnover.” The bulk of airline operating costs are fixed, and with the supply of seats greatly in excess of demand and with other new high costs, industry losses mounted to $20 million in 1947. Fares were raised twice, for at this time air travel demand was believed to be inelastic, and some airlines sought help from the Reconstruction Finance Corporation. A retroactive subsidy payment of over a million dollars was rushed through to keep Trans World Airlines (TWA) from trusteeship.The effect of this debacle on further purchasing was cancellation of $150 million in airliners ordered earlier, and as an additional blow export orders faded in 1947 because of the lack of dollars abroad. Not surprisingly, other government aid was sought and offered. In 1948 a bill passed the House of Representatives to provide government financing of civil transport development. Government monies mean government control, and when the aerospace industry learned that the government intended to restrict the number of firms involved to three, as well as to decide on the types made, design changes, and sales prices, the firms found the cure to be worse than the disease. The manufacturers fought the idea and it was defeated. At the same time, a major change was in progress which had been interrupted by the war: the predominant airliner type was changing from two to four engines. The four-engine aircraft, with its greater speed, range, and capacity, was both cheaper to operate—unless it was a giant so large it could not be filled—and more appealing to passengers. It is cheaper to operate one aircraft with forty passengers than two planes with twenty passengers each. It was also important from a safety standpoint. Because of the wide gap in piston engine performance between the short-term and long-term power reliably produced, it is possible to take off with weights that cannot be sustained in cruise. The International Civil Aviation Conference in Chicago in 1945 recognized this potential hazard, and government rules setting demanding performance limits were established. These requirements added greatly to design problems, and therefore to costs, and were a spur to improvement. The indirect upshot was to force adoption of four-engine aircraft for many routes, for an engine failure is obviously less critical with four engines than with two. Thus, for operating and safety reasons the four-piston engine airliner was a natural basic type for almost all commercial air transportation, and it represented the main market in the postwar years as conversion from twin-engine airliners took place. EXPANSION: 1948-1955The large four-engine airliner, with its then wide body, lent itself well to the desperate measure taken by Capital Airlines in 1948: the introduction of aircoach service. The idea had been pioneered by a nonscheduled airline, North American Airlines. Capital increased seating capacity per airliner by 50 percent and cut fares by one-third, so that, with the same number of transports, gross income would be equal. Their gains would have to come from attracting more customers, and Capital gambled on the possibility that air travel demand was elastic; their approach thus ran counter to the prevailing view, which relied on product differentiation in the form of services rather than competition with fares. Capital’s experiment was opposed by other airlines, and it was permitted by the Civil Aeronautics Board (CAB) only with reluctance. United Airlines was bitterly opposed because its president, W. A. Patterson, believed strongly that demand was inelastic and that aircoach destroyed any hope for airline prosperity. United fought aircoach for years, and its final losing attack in 1952 was a charge that aircoach crowding was unsafe.

It was the four-engine piston airliner which developed the mass market for air transportation, exemplified by the great Douglas DC-B. Courtesy McDonnell Douglas Corporation. Aircoach proved hard to resist, as every additional passenger pays a fare which is almost totally a contribution to fixed costs. The concept was an instant success, but it grew slowly as the CAB gradually gave ground and airlines were forced into it by competition, for they long retained a belief in the inelasticity of demand. Its introduction coincided with a round of rail-fare increases so that railcoach tickets became more expensive than aircoach. The railroads, competitive until their fare increases and the introduction of aircoach, faded rapidly. In 1952 aircoach spread to transatlantic service, when Pan American introduced it despite reluctance on the part of the International Air Transport Association (IA T A), and there was soon a decline in steamer traffic. Aircoach, supplemented by other fare cuts, has changed air transport from a limited service to mass transportation. The ?airlines have come to accept the fact that they do deal with an elastic demand curve, although its shape has not been agreed upon. Some believe a cut of x percent in fares will generate a 2x percent increase in traffic. Following aircoach there have been credit systems and a flood of promotional fares: for youth, families, servicemen, wives—generally any group except businessmen, who have made up three-fourths of the customers. Besides price competition, efforts at product differentiation have been intensive. The airlines have continuously sought to provide faster, more comfortable, and more attractive airliners, and this has enhanced aircraft sales. Aside from these marketing factors, the airlines in 1948 began to take internal measures to get their costs under control. Many executives had returned to the airlines in 1945 from service in the Army Air Forces’ Air Transport Command and had retained a tendency to acquire staffs, facilities, and equipment without reference to cost. The natural trend in prosperity for business to add staff without emphasis on costs furthered the abuse; and another cause for overmanning was that the airlines at this time were recipients of government subsidy. In the shakeout of 1948-1949 United Airlines cut its staff by 20 percent without loss in efficiency. At the same time, the need for training on the postwar airliners fell off while the greater efficiencies of the newer transports were increasingly realized. With these measures the rest of the airline industry joined cost-conscious Eddie Rickenbacker’s Eastern Air Lines to show profits in 1949. Eastern did not lose money any year. And as profitability returned so did airline credit revive, making purchase feasible. Approaches taken by the different aerospace firms after World War II differed in method and in degree of success. After the war the Martin Company entered the commercial airline field for the first time. To assure success it took a market survey and sought advice from American Airlines, and it decided to get a head start on competition by by-passing the prototype stage and going directly into production. This tactic proved costly because of the changes that had to be made during production. Martin succeeded in 1947 in beating the twin-engine competition into deliveries, only to find that its product was inferior. Having followed indications of the survey and American’s advice, it had an austere airliner which did not attract passengers. Worse, its operating costs were higher than the competition’s. A company financial crisis followed, for there were no airline or military sales of consequence to sustain the firm. Successfully surmounting the crisis with government aid, Martin corrected its design errors and tried again; and it was into fabrication when the Korean War brought production dislocations and another financial crisis. The new management abandoned the commercial field to its rival, Convair, which by that time was well established as the leading manufacturer for twinengine airliners.

The airlines told Martin what they thought they wanted in an airliner, but when the 202 was built they found they had not known their own desires. Courtesy Martin Marietta Corporation. Convair’s path to this position was difficult. It had an advantage in design knowledge because of its wartime airline operation, Consairway. However, its first prototype, Model 110, did not sell. American Airlines suggested changes, which were adopted, although they were so extensive that the plane was renamed Model 240 and the 110’s tooling was scrapped. Strikes and design changes raised costs, and Convair, like Martin, came close to bankruptcy. When the 240 did reach the market and airline expansion began at the end of the forties, it and its variations (340 and 440) proved to be the second most popular American piston twin-engine airliner built, with production totaling around 1,100. Another company which put an airliner into serial production believed it had an advantage upon which it could capitalize. Boeing had been the first to produce a modem airliner, the 247, and the first in the U.S. to build a four-engine transport, the Stratoliner. Neither was successful, but after World War II Boeing believed it could translate its highly successful military B-29 and C-97 designs into an airliner. To help assure success, Pan American, an old collaborator, was made a virtual design partner. The military structure proved to be a handicap as well as an advantage, because extensive and costly changes were required for civil use and to meet the new civil regulations mentioned above; Boeing estimated, however, that $25 million in development was saved by adapting the military designs. The company had set out to build an economic transport that would be popular with passengers. Popular it was, but not economic, and Boeing lost over $13 million on the Stratocruiser, having sold only 55 models.4 This was a large but not crippling sum for a company whose sales averaged only $113 million from 1946 through 1949 when the Stratocruiser was developed and built.

The only successful postwar piston two-engine airliner was the Convair 240 family. A 340 model is shown. Courtesy General Dynamics Corporation. The most successful airliner builder in terms of market penetration was Lockheed. Although Lockheed did not sell as many airliners as Douglas, it very much improved its market position over the thirties. Lockheed, an aggressive and daring competitor, took the risk of starting production of the civil version of its Constellation (“Connie”) as soon as the war was over. It won a significant lead of eighteen months over Douglas and Boeing, gaining a secure foothold in the market of the forties and fifties. Its several versions of the Connie were developed in hot competition with Douglas, and they have proven to be among aviation’s great designs. Comparable, if not superior, to the Connies was the superb Douglas DC-4/DC-6/DC-7 family of airliners. Built in the Douglas tradition of low-cost operation for an airline, the DC-6 family continued Douglas’ domination of the world’s airlines in the fifties, while the revenue passenger-miles of U.S. airlines were increasing steadily at the growth market rate of around 14 percent a year. The expansion of 1948 to 1955 was a gradual one. Because the large airlines were unenthusiastic about aircoach, its impact was underrated and delayed; for once, airline management lacked the overoptimism that has at other times led to buying too much too soon. During the Korean War, fabrication of airliners was held back for military production, an artificial restraint. There was also some uncertainty about the nature of the next “generation” of airliners: would they be piston or propjet conversions? These factors all produced an unusual period of prosperous airline expansion without the characteristic wave of enthusiastic buying followed by a glut of capacity. THE FOREIGN CHALLENGEThe Douglas and Lockheed airliner domination might have been comfortable except for the jet engine and some determined competitors. During the Second World War, Britain decided to use its aeronautical leadership to create postwar global primacy in export aircraft. The key features of the program were government financial backing and the strategy of getting an early technological lead. The instrument was to be the revolutionary jump to jetliners and propjets.Two of the British designs, the famous De Havilland Comet and the Vickers Viscount, achieved instant, startling success, verifying the soundness of the basic strategy. The Viscount even won a strong foothold in the American domestic market, and the Comet almost did. A total of 438 Viscounts were built. The great expectations vanished almost as rapidly as they had seemed to be fulfilled. The Comet suffered a series of spectacular, devastating crashes. By the time the fault had been found in 1954, the Comet’s lead had evaporated, its reputation had been tarnished, and its improved models faced stiff competitors in the Boeing and Douglas jetliners. Nor were the derivatives promoted as was Comet 1. Although alternative propjet designs to the Viscount existed, there was no immediate back-up design for the Comet. Of necessity, the British pinned their hopes on the propjet Viscount, and the Viscount justified these hopes for awhile: its success probably contributed to Lockheed’s decision to build a propjet instead of a jetliner. Its success also led the British to emphasize the propjet Britannia; but the Britannia competed when the jetliner was gaining passenger popularity, and only 80 were sold. Britain’s share of the world aerospace market was 10.2 percent in 1964 and 14.5 percent in 1970.5 Hard on the heels of the British challenge came one from the Russians. A drive for export sales was made with their sleek Tu-104 jetliner, but negotiations broke down in 1958 with the first interested customers, Arabian airline firms, because the Russians refused to divulge performance data in advance of the sale. Hindsight indicates this was done because of poor performance and not the Russian penchant for secrecy. The Tu-104 proved very expensive to operate, in several ways, besides being a great fuel hog. After four years of regular service the Tu-104’s averaged only 150 flying hours per month. Since the Tu-104 the Russians have attempted to export several airliner models to non-Communist countries with only minor success. Like the British, the Russians erred in emphasizing the propjet for awhile, and the Russian jetliners have simply not been as efficient as those of the West so far. The French were the first to build an airliner using tail-mounted engines, a design which the American industry had long flirted with. The Caravelle pioneered the short-range jetliner when it went into service in 1959, and it was popular. France sold many for export, but production had not progressed far beyond the break-even point when hot competition appeared from later American and British short-range jetliners. The famous Dutch Fokker company produced a high-wing propjet design, the F-27, which achieved some popularity but fell far short of Dutch ambitions for it as a DC-3 replacement. It was built by Fairchild in the United States, under license, beginning in 1957. But most Americans are of the opinion that the heavy weight penalty of longer landing gear and of structure to suspend the fuselage beneath the wing makes such an airliner unable to compete economically with a low-wing airliner; this factor is one reason that high-wing military transports have not been bought by U.S. airlines. BOEING’S TRIUMPH: THE AMERICAN JETLINERAfter much indecisiveness and many false starts the American aerospace manufacturers produced jetliners to meet the foreign competition. Despite the advantage of numerous jet bomber designs sponsored by the Air Force, and the profusion of postwar airliner designs, no jet development went beyond the paper stage for seven years, from 1945 to 1952. Americans did not realize the jetliner age was at hand. The airlines, which were struggling for most of these years and so lacked interest, money, and daring, gave the jetliner but a cursory glance because of the fuel-hungry jet engines of the period. During the fifties, when jets became available, the government thought the airlines were healthy enough to come off subsidy, a departure that caused some worry. Few persons except fighter pilots knew of the superiority of jet flight in human terms, and the jetliners’ popularity was not anticipated. The hard-pressed aerospace manufacturers did not dare risk funds on as great an unknown as a jetliner. The airlines waited for the manufacturers to make a move, and the latter waited on the airlines. Yet there was continuous speculation, and design studies were made of jetliners when the industry emerged from the trough of 1947. Most planners believed that the first step should be to convert the DC-B’s, Connies, and Convair 240’s to propjet power, and a serious but aborted move in this direction was made by Convair with an Allison engine in 1950. The propjet, whether a conversion or a new design, was regarded as the natural and economic intermediate step to the jetliner, if not permanently better. As late as 1954 the initial jetliner market was believed to be only fifty aircraft. There was a significant exception to this line of thought, however: the brilliant Juan Trippe foresaw that the jet would be superior to the propjets, and he had already ordered Comets. It was Trippe’s big jet order in 1955 for forty-five for Pan American alone, twenty 707’s and twenty-five DC-8’s, that truly opened the jet age in airliners. There had been enough interest in new designs before 1952 to spur repeated efforts to get the government to pay for jetliner development; these calls were made vigorously after it became obvious that just talking was not an adequate response to the British challenge. The shock of finally recognizing the British lead caused an American reappraisal which was a small foretaste of the reaction to Sputnik.

Unique among airliners is the General Dynamics 600. It alone is a conversion of a piston airliner to propjet power. Courtesy General Dynamics Corporation. Boeing was a leader in the attempt to obtain government financing. The company either accepted jet effectiveness intuitively, because of its experience with jet bombers, or was convinced by the Comet’s performance. By 1954 Boeing knew the jet was superior, believing that a 707 would do three times as much work as a single piston DC-6 at only double the operating cost. Boeing underestimated: the jet would prove to do five times the work, not three. It had been generally expected that Lockheed would be the leader in jet transport development. Not only did Boeing score an upset, but Lockheed proved to be uncharacteristically timid, both in being late and in building a propjet. Boeing was the first American firm to move ahead into jetliners, and it forged one of the great business success stories. By 1972 Boeing had sold 2,300 jetliners for sales of about $20 billion; Douglas had sold 1,200; and Lockheed only 188 Electras. Boeing’s achievement was primarily a result of four factors. First, President William Allen’s acumen provided the funds. Unable to get direct government financing, Allen created opportunities for Boeing which resulted in indirect government financing of much of the development and tooling costs. Thus he escaped the government controls which necessarily accompany direct government subsidy. Second, Boeing saw the technology far more accurately than the other firms, having studied large jet design in depth for years and having produced two superb bombers. Third, an aggressive sales campaign was undertaken. Fourth, Boeing’s main competitors believed in another generation of piston liners and overrated the propjet. From being a three-time loser on airliners, Boeing became the jetliner champion. With trepidation, Allen took the plunge on building his jet in early 1952. Having believed since 1948 that jet engines were feasible for airliners, he and his staff now thought the technology was ripe and the staff was straining to start. There was little prospect of shifting the whole financial risk to the government, after several unsuccessful attempts to do that had been made. But cash was flowing in with the Korean War boom in bombers. The stiff excess-profits tax, based on the lean 1946-1949 years, nearly eliminated profits; therefore monies could be spent on development instead of being paid in taxes, and the government indirectly would pay, not Boeing. The effective tax rate for Boeing was 82 percent, a figure which gave it an advantage in this means of financing over Lockheed, taxed at 48 percent, but not so much over Douglas at 68 percent. In 1962 the tax court ruled that Boeing was not entitled to divert tax money in this way, but by then Boeing could easily afford to pay the taxes. Allen also anticipated the Air Force’s desire for a jet tanker, and the 707 was designed to be compatible with both tanker and airliner requirements. The prototype was built so it could be a tanker, but when it was rolled out in 1954 it carried airliner-style paint. The Air Force was conducting a jet tanker design competition at this time and named Lockheed the winner over Boeing, Douglas, Convair, and Fairchild; but since Boeing had an acceptable prototype it got a production order in 1954, and ultimately built 564 KC-135’s. Thus Boeing had a prototype and a production order in the same year that the Comet was permanently grounded. The timing meant that when production began on the tankers nearly all prototype and initial production problems were found and fixed at government expense. Finally, Allen persuaded Air Force Secretary Harold Talbott in 1955 that production of the 707 and KC-135 on the same line would save money for the government as well as for Boeing; so the production tooling for the tanker was available for the liner. Lawyer Allen’s series of financial maneuvers must be one of the shrewdest coups in business history. The importance to Boeing is shown by the fact that the company did not break even with these advantages until 1964, twelve and a half years after starting the jetliner. Additional costs were incurred, after initial development, by work on variant models which were necessary to remain in competition but which delayed reaching the break-even point. With overall financial success, however, Boeing could afford this product diversification; but other companies, Douglas for example, could not.

The master stroke: this is the Boeing prototype for the 707 jetliner and the KC-135 tanker at rollout on 14 May 1954. Notice the absence of windows and the implied airline markings. The paint scheme was brown and yellow. Symbolic of its grand achievement, this airplane was turned over to the Smithsonian Institution in 1972 as “one of the 12 most significant aircraft of all time.” Courtesy The Boeing Company. Despite Boeing’s experience with jet bombers its progress in designing the 707 was not simple. One hundred and fifty designs on paper were made before the final one. Until 1950 the effort went into a false start. Boeing, like the other aerospace companies and despite its bomber experience, was a prisoner of the idea that the jetliner should be a direct outgrowth of the four-engine piston airliner design. Two very practical reasons for clinging to the old form was Boeing’s desire to use the Stratocruiser assembly line and tools to save money, and also the strategy to produce a design useful for both tanker and transport. As work progressed and new engines were developed, the designs wavered back and forth between jet and propjet power. The first important model was even designed as a hybrid, with four piston and two jet engines, perhaps a parallel to the B-36 concept. Subsequent designs were propjet or jet. In 1950 a new direction was started which did not use Stratocruiser parts, and this approach became the 707, dominated by its B-47 and B-52 heritage. Design elements of the Stratocruiser fuselage were incorporated into the 707 as well, so that all three aircraft are its forebears. Triumph in design was not enough. To be successful the 707 would have to be sold by a company traditionally weak in commercial transports and in competition with the long-time champion, Douglas. Boeing did succeed, even though after the achievement its salesmen were still regarded as amateurs alongside Douglas’. To counter Douglas’ sales point of its long airliner experience, Boeing presented its record with big jets; to Douglas’ claim that its later design could accommodate customer wishes, Boeing opposed a promise to deliver earlier and to alter the 707 to airline desires; and in fact the fuselage was widened by four inches at American Airlines’ demand. To overcome inexperience of the sales staff, Allen sent his top executives out to sell. The number two man at Boeing, Wellwood Beall, an engineer who had a role in developing the 707, was sent with a team to sell in Europe; he held the authority to make decisions on the spot. Boeing devised a particular stratagem to sell to Britain’s main airline, British Overseas Airways Corporation (BOAC); this was to sell first to Commonwealth countries, in the anticipation that there would then be less resentment to BOAC’s purchase of an American jetliner. Transactions were made with Australia and India; then in England the Boeing men made their appointments through BOAC with government officials whose approval they needed. BOAC bought the 707. In their sales efforts, the Boeing men traveled more than Douglas’, and it seems evident that Boeing’s drive, ingenuity, flexibility, and hustle paid off. While Boeing was conducting its design development in secrecy, its competitors were floundering with indecision and abortive efforts. Their success with piston airliners deceived both Lockheed and Douglas into overrating the future of the type, and made them chary of change. Lockheed mistakenly believed that by 1965 only 1 percent of airliners in service would be jets. Sales for piston airliners were high; a powerful piston compound engine became available, and with it both companies launched new stretched versions of their piston airliners. The new models sold well; for example, Douglas received 200 orders for piston liners in the first half of 1955. Their faith in propjet versions of their new airliners was misplaced: conversion failed because the airframes of the piston liners were designed for low speeds and proved unadaptable. Both companies, however, continued to believe that the propjet airliner had the best sales potential for the next decade. The highly successful Lockheed C-130 propjet military transport and Douglas’ abortive C-132 propjet probably helped lead the companies along the false direction, and when Lockheed won the American Airlines design competition for a medium-range propjet airliner in 1954 the die was cast. Lockheed was committed to the Electra, being influenced by the fact that it had allowed both Boeing and Douglas to get ahead in time on jets. The Electra ultimately failed, not so much because of the series of disastrous crashes which resulted in a costly modification, but because the propjet could not compete with the jet. The Electra was the best, although not the only, proof that the airlines are not always the best judges of their equipment needs. In addition to pursuing unsuccessful leads in design, Lockheed and Douglas had shrunk from taking the financial risk of starting development early; when they decided they had no choice but to go ahead, the risk had become greater because of Boeing’s lead. Both delayed in hopes of getting the tanker contract, allowing themselves to be outmaneuvered by Boeing. Thus Lockheed’s timely L-193 jet design of 1951, a swept-wing with the engines mounted at the tail, was allowed to die. In fairness to Douglas it must be recognized how large the financing problem was without the clever stratagem used by Boeing. When Douglas failed in 1966, its DC-8 development costs still had not been paid off. Douglas had a psychological reason to delay. The first two times that Boeing had taken a major step forward in airliner design, with Model 247 and the first Stratoliner, Douglas had followed with superior results, the DC-3 and the DC-4, which took advantage of the Boeing research and experience. Donald Douglas, Sr., said, “In our business, the race is not always to the swiftest nor the first to start,” and “There may be some distinction in being the first to build a jet transport. It is our ambition at Douglas to build the best and most successful.”6 This time the strategy was a fatal mistake. Not only was Boeing ahead in time, but it had a design which Douglas was unable to improve upon significantly at first.

Lockheed won the American Airlines design competition for a propjet airliner, the Electra, which only demonstrated again that the airlines have not been the best judges of their needs. Courtesy Lockheed Aircraft Corporation. An even later entrant in the jetliner sweepstakes was General Dynamics, which hoped to continue to expand its commercial business. To avoid direct competition with the giants, Boeing and Douglas, General Dynamics elected to enter a new field, the medium-range jetliner, where no other company was involved except Lockheed with its Electra. The General Dynamics airplane, the 880, was well designed, but it foundered for several reasons. It was, like all Boeing’s competition, late, a condition that was aggravated—perhaps decisively—by Howard Hughes’ order. Hughes persuaded General Dynamics to accept a condition along with his purchase for TWA that no 880’s would be sold to anyone else for a year, a condition which was intended to assure supply. The timing cost sales and it also prevented General Dynamics from sidestepping competition, for after Boeing completed its 707 it shrank the design, in 1957, to offer a medium-range airliner, the 720.7 It was more economical for maintenance and supply reasons for an airline to have an all-Boeing or an all-Douglas fleet than to mix brands of aircraft or engines. General Dynamics found itself in further difficulty with the 880 because the capricious Howard Hughes vacillated and, in an internal TWA squabble, ordered his 880’s, in various stages of completion, into storage. Finishing these aircraft, once they were half completed and off the assembly line, was very expensive. General Dynamics also suffered from a lack of cost control and supervision.

Douglas’ bid for the jet age, the DC-8, was not superior in performance to the competitive Boeing entry. The resultant financial, managerial, and engineering strains seriously damaged Douglas. Courtesy McDonnell Douglas Corporation. With the 880 in trouble, General Dynamics sought to recoup through technology instead of cutting its losses. In 1958 it designed the 990, a full-scale jetliner, hoping to compete with the 707 and DC-8 by using Whitcomb’s area rule on an airliner for the first time. The new design was intended to give the 990 a significant speed advantage. The first model failed to reach the desired speed, and extensive modifications to reduce drag had to be made. When the 990 did achieve its design speed, it became apparent that it still lacked a competitive advantage: the margin in speed would have been decisive in the piston age but was relatively small compared to the 707 and DC-8, and the 990’s range was also somewhat less than its competitors’. In addition, to get the desired speed General Dynamics reduced seating from six to five abreast, an arrangement which the airlines considered to be less advantageous. The 990 did not sell in any numbers: only 37 were built. It’s timing was even worse than the 880’s, coming out in 1961 during a period of overcapacity for the airlines. The 880/990 program was a financial disaster, losing over $400 million and bringing mighty General Dynamics to its knees. The company has since tiyed with the idea of returning to commercial aviation with its own design but has not committed itself beyond studies.

An excellent but ill-fated design was the 880, which was General Dynamics’ bid to maintain its short-range airliner market. Courtesy General Dynamics Corporation.

The double-or-nothing airliner. With 880 sales in difficulty General Dynamics sought an end-run through technology with the 990. This view shows the bulges on the trailing edges of the wings, which were an adaptation of Richard T. Whitcomb’s area rule. Courtesy General Dynamics Corporation. The final entry in the first wave of jet-age airliners was Fairchild. This company sought to sidestep both competition and development costs by entering the short-range market as a licensee of the Dutch Fokker two-propjet F-27 Friendship. Fairchild hoped it would replace the DC-3, at last, so that total sales would be 1,000. A market survey in 1954 was favorable, but hopes to sidestep competition ran into trouble when General Dynamics produced a kit for easy and cheap conversion of its Convair 240 family to propjets.8 A major problem was that Fairchild’s market, the feeder airlines, lacked access to funds. By 1963, after six years of production, only 101 had been built. Fairchild had run into expensive problems $mdash;in adapting the airframe to its own production, with language, with Fokker’s handcraft manufacturing methods, and with the metric system and although Fairchild’s difficulties were modest compared to those of Lockheed and General Dynamics, they caused a corporate crisis. From 1958 through 1960 Fairchild lost $29 million, before taxes, on sales of $347 million. Net worth fell from $37 to $16 million. OVEREXPANSION II: 1956-1960With the production restraints of the Korean War removed, the airlines embarked on a second airliner buying spree in the last half of the fifties which caused them to join the transport makers in travail. Passenger revenue-miles in the early and mid-fifties grew at a rapid rate. High earnings and the rapid depreciation allowances of the Korean War years provided purchasing funds. The last improvement on piston airliners became available and made up most of the buying wave of 1956 to 1958, as airlines were still skeptical of the jet. Just behind an order surge of $250 million for piston liners came the first wave of propjet and jetliner buying for delivery in 1959 to 1960, kicked off by a Pan American order in 1955 worth $269 million, the largest in airline history to that time. The airlines now had a situation which was very nearly double-equipping, a result of the error in timing the advent of the jet age. The over 850 transports which went to the American airlines in this buying orgy involved a capital investment, in flight equipment alone, of over $1.5 billion, almost 50 percent more than the original cost of the 1955 fleet. For the significance of the size of this sum it can be compared to trunkline assets of $1.3 billion and net worth of $650 million. The role played by competitive pressure in buying the jets is implied in the lament of C. E. Woolman, the president of Delta Airlines: “We are buying airplanes that haven’t been fully designed, with millions of dollars we don’t have, and we are going to operate them off airports that are too small, in an air traffic control system that is too slow, and we must fill them with more passengers than we have ever carried before.”9At first the airlines worried about finding the funds for this growth, but long-term financing was readily found in banks and insurance companies. The financial community was impressed by the volume of traffic the airlines had reached, and accepted air transportation as being on a firm foundation. But Fortune magazine ran an article in 1956 expressing alarm at the buying binge, calling it a flight from reality.10 C. R. Smith, the president of American Airlines whose overoptimism in 1946 is reported above, scoffed at the pessimism, saying demand would prove higher and supply lower, and that Fortune had failed to consider the retirement of older aircraft.11 OVERCAPACITY II: "THE PIT" (1957-1962)It turned out that it was Smith who miscalculated, for the binge generated the hangover of another period of overcapacity, beginning almost as he wrote. The number of seats had tripled in a decade; as before, costs were allowed to rise outside the need for training expenditures for the new jetliners; the Civil Aeronautics Board, like the airlines, repeated the error of assuming permanent prosperity had arrived, and busily added carriers to routes; the used airliner market temporarily collapsed under the supply: nearly new DC-7’s and Connies would not sell at any price in 1958, although the airlines were able to pass on some of this problem to the sales-hungry manufacturers by demanding trade-in discounts for piston airliners. The productivity and reliability of the jets greatly exceeded general expectations. A graphic example is the $5 million 707, which could carry as many transatlantic passengers in a year as the $30 million Queen Mary, and with about one-tenth of the fuel; and one 707 flew 250 million seat-miles per year compared to 50 million for a DC-6B.With the long-range jets driving the pistons and propjets onto the medium- and short-range routes, the aerospace manufacturers turned their attention to the latter markets during this period of overcapacity. With the failure of the Lockheed Electra, the Convair 880, and the Fairchild F-27, the sole competitors at first were Boeing and Douglas. Boeing first shrank the 707 to a four-engine medium-range jet, the 720, in 1957. Soon thereafter it decided there was a market for another step-down in size, but this time the step was not so easy. Continuing downwards in scale while keeping four engines was uneconomic, but the use of two engines ran into the safety-reliability prejudice, backed by government regulations, held over from the less powerful and less reliable piston engine. Another prejudice long delayed another option, adaptation for three engines.12 Boeing’s consultations with the buyers were of little help: American Airlines believed twin engines was the answer; United and Continental wanted four engines; Eastern and TWA suggested three. Boeing finally shook itself free of the piston tradition and started in 1960 to design the three-jet 727, which may prove to. be the most successful jetliner, and at that time the Federal Aviation Agency (FAA) began lifting some of the restrictions on jets that were derived from the piston era. Boeing’s decision to broaden its product line, although ultimately wise, meant development costs, and the 707 family continued in the red during the period of airline overcapacity. The abrupt twilight of the bomber ended its lucrative military-production days, and Boeing’s finances were difficult. But if finances were strained for Boeing, they were critical for Douglas, which also believed there was a market for short-range jetliners. The disastrous decision to allow Boeing the jetliner lead meant many lost sales, and Douglas found itself in the familiar position of incurring heavier development costs than expected. Also, it moved down the DC-8 learning curve abnormally slowly and without benefit of . the shrewd gambits that Allen had pulled off. Douglas, like Boeing, was also seeing its government business wither, removing a financial prop. Douglas tried a gambit of its own: it agreed with the French to build and sell the short-range Caravelle as a means of avoiding development costs. But Douglas found itself unable to sell the Caravelle, and it was forced to go ahead with designing its short-range two-jet DC-9.  The Fokker and Ford trimotors won a major but very transitory place in airline history. The three-engine concept returned with the versatile and efficient Boeing 727, whose success encroaches on that of the past champion: the Douglas DC-3. Courtesy The Boeing Company. OVEREXPANSION III: THE JETS TAKE OVER (1965-1968)The DC-9 was ready when the next period of violent over-expansion began. By 1963 the American economy had turned upwards, and the continued growth of air traffic, as the jet showed its superiority, had caught up with the supply of seats. Piston airliners still made up 57 percent of all commercial transports but were relegated to the short-range routes; they had by then been amortized. With economical short-range jets available$mdash;the Douglas DC-9, the Boeing 727, and the later 737—the airlines undertook to go all-jet, exactly as Douglas and Boeing had hoped. This time there was a renewed British invasion with a similar short-range jet, the BAC-111, a successor to the Viscount. The BAC-111 even entered service months before the DC-9 in 1965, but the American airlines preferred the Boeing and Douglas products. On 1 January 1969 there were 543 727’s, 266 DC-9’s and 60 BAC-111’s in service on U.S. airlines. A third contender in the short-range market was again Fairchild, offering an improved version of its high-wing propjet, the FH-227. Airline preference was for the low-wing jet, however, and sales for the FH-227 were only 68 in the boom years of 1966 to 1968.The popularity of the slick, comfortable small jets made them profitable, even when their trips were so short they started descent immediately after reaching cruise altitude.13 In 1965 air travel demand took a sudden jump, and in 1967 100 billion passenger revenue-miles were flown, to be compared to less than 50 billion in 1962. In 1966 the U.S. airlines added as much seat capacity as they had possessed in 1950. They now had more jet transports than pistons, 1,378 to 873, and the pistons provided only 11 percent of the service. In 1967 the airlines accepted deliveries of 388 jetliners worth $2.1 billion, and had another $10.5 billion worth on order. In 1970 75 percent of U.S. domestic air travel was for less than 500 miles, and jets made up 57 percent of the liners serving this market. Amidst the euphoria customary at such a time, the reequipping turned into another buying binge. Money was easily borrowed because of the profit record of the jets, and the jets themselves were producing a high cash flow. Besides making massive equipment purchases, the airlines behaved as they usually have in other such prosperous times, adding new flights until empty seats were epidemic, hiring many persons, and granting huge wage increases. The Civil Aeronautics Board followed its customary pattern on the upside of the cycle with a flood of new route awards, crowned by more new ones in 1969 than in the previous thirty years combined.

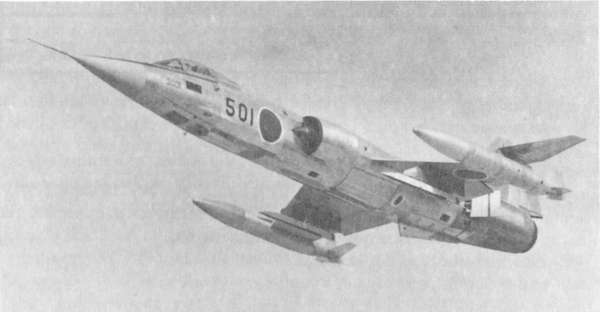

Despite its virtues the short-range Fairchild FH-227 could not overcome the view by United States airlines that a high-wing design has too many disadvantages for an airliner. Courtesy Fairchild Industries, Inc. By 1969 the inevitable crisis returned. Costs had begun to outrun revenues. Douglas had been swamped with orders for which it was totally unprepared and which generated capital problems similar to those of a new company expanding out of its beginner size. Giant though it was, Douglas failed in 1966 in the midst of the boom and was absorbed by McDonnell. During the prosperous period, development was begun on two new types of airliner design. With improved thrust-to-weight ratios it was hoped that a giant airliner, or “airbus,” with high performance and an expected one-third lower seat-mile cost, was practical. The new jumbos, designed with two or three engines, were aimed primarily at forcing the retirement of the more operationally expensive 707’s and DC-8’s. Design work on the C-5A strategic transport had assured the jet makers that giants were practical, and the three leading contenders for the C-5A contract now adapted their C-5A bids to commercial purposes. Boeing designed its 747, Lockheed its L-1011, and Douglas the DC-10. This time Boeing was too early. In 1965 it adapted its C-5A design with the same engines, producing a heavy, four-engine model; and having made this investment Boeing was reluctant to build a new design when better engines were imminent. The new designs broke with the past sufficiently to give Lockheed a chance to regain a leading position in commercial aviation. It seized the opportunity aggressively but lost its time advantage in the crisis following the collapse of its engine supplier, Rolls Royce, in 1971. Douglas had delayed working on the new designs because of its financial problems; but after the merger, McDonnell’s firm leadership and desire for commercial business finished the development of the DC-10, With Lockheed’s lead lost, and because of the great similarity between the L-1011 and the DC-10, intense price competition resulted between Lockheed and Douglas; there was a series of price cuts between the two companies in 1968. Meanwhile, Boeing was diverted by its concentration on the troubled technical development of the second new type of design, a supersonic transport (SST), under a government contract awarded in 1966. The SST was eventually canceled because it lacked an economic basis and was opposed by environmentalists. And the giant airliner undoubtedly contributed to the death of the SST, for it was cheaper and it offered possible solutions to some of the pollution and congestion problems arising in air travel. Boeing lost the time spent working on the SST, and the 747 went into service in 1969, just as the airlines entered another overcapacity crisis; the L-1011 and the DC-10 went into service in 1972, when conditions were still worse. THE EXPORT MARKETBy the time of the giants, American dominance of the world airliner market had been retained; 70 percent of the free-world airliners were of U.S. manufacture, and about 90 percent of the jetliners. After 1948 dozens of new ones were exported each year, with over 400 delivered in the years 1966 to 1968. In the sixties their value, plus the lucrative parts sales, was in the hundreds of millions of dollars; it reached one billion in 1968 and one and one-half billion in 1970. There has also been a large business in used civil aircraft.Exports of military aircraft, new and used, have also been a valuable market, despite some political restrictions such as denying sales to countries which our government thinks should buy butter and not guns. After the war military exports were primarily financial aid, but with the American balance-of-payments problem they have become a tool of fiscal as well as defense policy since 1963. The principal salesman has been the Department of Defense, a fact which may have inhibited rather than spurred sales. From 1949 to 1966 the U.S. government sold $16.1 billion worth of arms and gave away $30.2 billion worth; the military aircraft share of arms sales was about one-third. Most of this business was not handled directly by private firms. The biggest single program was the building of F-104’s for export and the licensing of their manufacture abroad: 600 were sold abroad, and 1,500 were built under license. Foreign aerospace products have been imported, but the balance has run heavily in the American favor.  Long the backbone of the free world’s air forces was the Lockheed F-104, a success in the export market. Shown is the Japanese version, the F-104J. Seven nations manufactured F-104’s for use by fourteen countries. Courtesy Lockheed Aircraft Corporation. FIGURE I FACTORS EXPANDING OR REDUCING AIRFRAME INDUSTRY MARKETS Source: Summary of text.

Figure I presents a chart which sums up the helpful or harmful effects of the

political, economic, and technological events on the aerospace industry’s

markets, military and space as well as commercial.

|